Managing Labor Burden & Calculating ROI

Table of Contents

Calculating Labor Burden Matters - Here’s Why

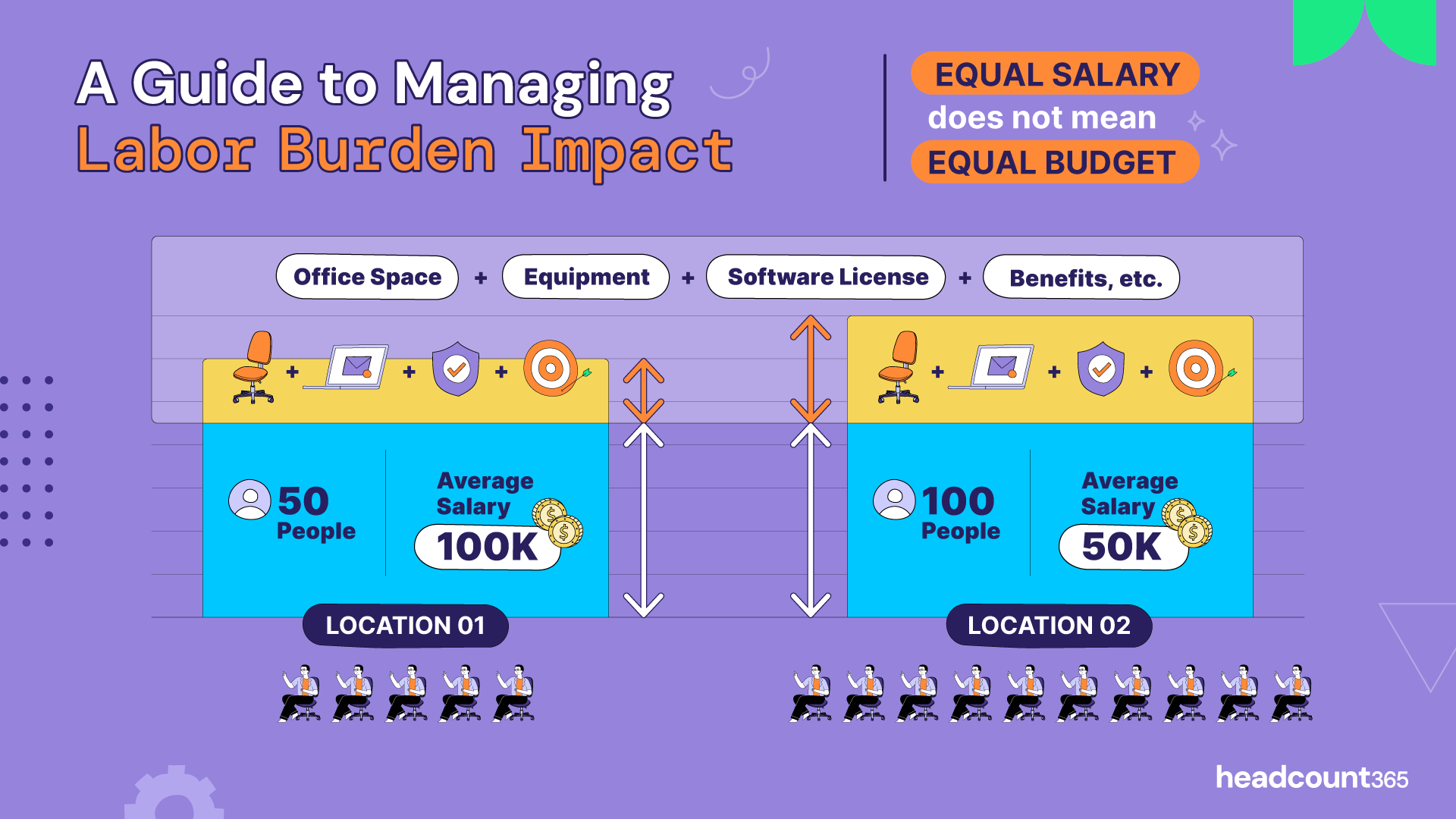

It’s not the hiring manager’s job to calculate the burden of employment. They have enough going on and typically manage using base salaries — with the ultimate goal of sticking to a total budget & getting their job done.

To a hiring manager, one $100k role split into two $50k positions is the same cost to the business.

Labor burden refers to the costs associated with employing someone beyond base salary, and these costs vary significantly by job type, location, job level, and numerous other factors. Miscalculation leads to inaccurate financial planning and poor headcount decisions. As budget owners “horse trade", backfill, or add new headcount, fully burdened costs can be the difference between making the budget or missing it. Here’s everything you need to know about Labor Burden and Headcount.

What Is Labor Burden?

Definition: All additional costs associated with employing someone, often expressed as a percentage or flat dollar amount over salary. Usually calculated at the back end of hiring plans, this data is the “real cost” of adding headcount to a business.

Common components:

Payroll taxes (FICA, unemployment insurance)

Health benefits

401(k)/retirement matching

Equipment/software licenses

Workspace costs (remote stipends or office allocation)

Labor burden has become increasingly important as companies trade headcount across borders in search of lower salary costs and higher output.

Styles of Managing Labor Burden

Choosing how to manage labor burden is a function of company size & makeup, who owns the calculation, and tooling.

Small companies in a single location, with narrow leveling frameworks, no outside sales function, and without an FP&A tool, may choose a flat percentage.

Global businesses with significant FP&A horsepower may choose an exact dollar amount.

There are tradeoffs to each, but generally, companies choose between the 4.

A. Exact Dollar per Employee

Used when employee-level data is available and burden varies significantly (e.g., high-end benefit elections, company cars, diverse software needs & license fees, etc).

Pros: High accuracy.

Cons: Resource-intensive and hard to scale for large orgs.

B. Department Averages

Use blended burden rate by department or job family (e.g., Engineering = 30%, Sales = 20%).

Pros: Easier to apply, still directionally accurate.

Cons: Can mask outliers or high-cost team, and still creates the need for “OPEX Slush Funds” to reconcile within category (a VP in the same department has a higher burden than an intern).

C. Flat Company-Wide Percentage

Apply a standard rate (e.g., 25%) across all employees.

Pros: Simple, fast.

Cons: Oversimplified, risky for nuanced orgs.

D. Geo-Based Burden Rates (Optional)

If operating in multiple geos, burden varies with local laws and benefits norms (e.g., EMEA, APAC).

Combine with the department average for high accuracy.

Labor Burden Best Practice - Controls in One Source of Truth

There are two key ways companies handle labor burden with hiring manager headcount requests.

Manage Labor Burden on every request

Pros: Less variance from approval to actual.

Cons: Laborious, and you need all of the data in place to make that call.

Handle core costs only, and reconcile later

Pros: Speed during the requests & approval process.

Cons: High Variance from approval to actual, which may lead to cutting other roles from the plan to make the budget.

Best practices no matter the style

Central ownership of burden assumptions — usually FP&A or HR Ops.

Documentation of burden components and their assumptions (especially useful for audits or executive questions).

Update cadence (e.g., quarterly or biannually) to reflect benefit rate changes, tax law changes, or policy shifts.

System tagging — ensure that planning tools (spreadsheets or software) clearly separate salary from burden components for transparency.

Applying Labor Burden to Headcount Scenarios

Labor Burden & Organizational Structures

As job level increases, labor burden typically increases as well. This isn’t always linear, but senior employees often have more discretionary budget, higher-tier benefits, and additional resources required to perform their role. In org modeling scenarios, cost per head should not be treated as flat across levels.

Labor Burden by Department

Labor burden varies meaningfully by function. Outside sales may include expenses for vehicles, travel, and entertainment. Inside sales might carry higher software costs and require physical office space. Departments such as IT, Legal, or Finance often require elevated tooling or compliance-related spend. Department-level planning should utilize differentiated burden rates, rather than a company-wide average.

Labor Burden by Location

Different geographies come with different employment costs — some visible, some not. Lower salary markets may have mandatory benefits, social tax obligations, or legal costs that offset initial savings. Domestic remote employees may also trigger additional stipends or IT support. Burden should reflect the full cost of employment by location, not just salary.

Economies of Scale & Labor Burden

Burden can shift with scale. Hiring into available office space looks different from expanding into a new lease. Shared tools and systems may have volume pricing tiers or license-based thresholds. In headcount scenario planning, it’s important to identify where scale leads to incremental burden increases.

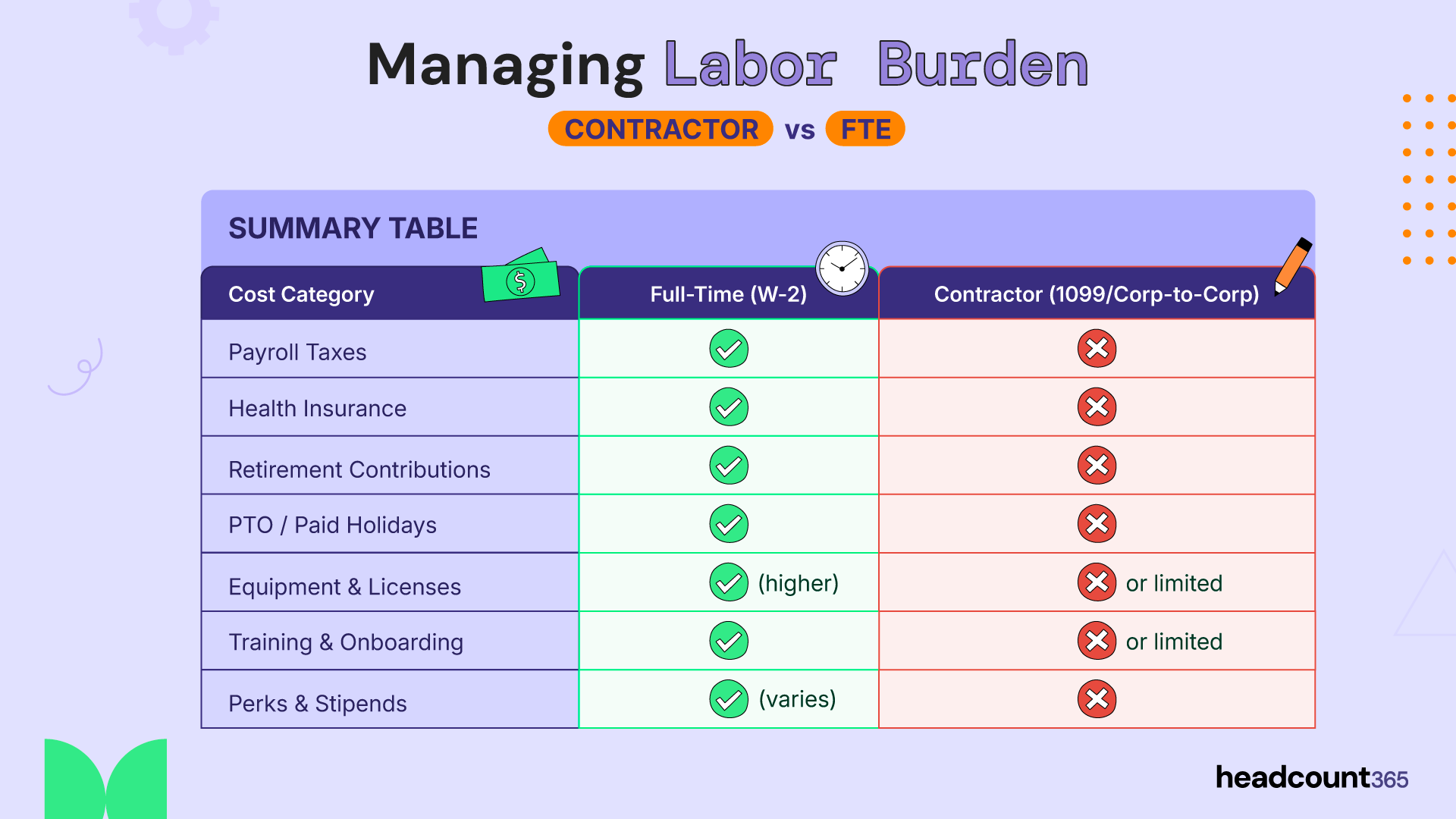

Full-Time vs Contractor

Contractors typically exclude most labor burden costs — no payroll taxes, no benefits, no PTO. While hourly rates are often higher, the total cost of employment can be lower. Contractors can also reduce long-term commitments by staying under fixed FTE budgets. Any scenario comparing employment types needs to reflect the structural differences in burden.

Employee classification has significant impact in labor burden.

headcount365 Creates Labor Burden ROI

headcount365 helps companies make decisions about all headcount by not only calculating cost, but delivering ROI. Labor Burden ROI helps quantify the return you’re getting on that full cost, especially when comparing different org designs or cost structures.

What is Labor Burden ROI? It Measures:

Labor Burden ROI = Change in Output Value / Change in Labor Burden Cost.

It tells you how much additional output you're getting for every dollar spent on burden.

Why Labor Burden ROI is Useful:

Helps justify a higher burden if it leads to disproportionate gains in output.

Makes cost comparisons more meaningful when salary budgets are flat across options.

Highlights when leaner orgs or different staffing models are more efficient.

Calculating Labor Burden ROI Example:

Scenario A: 10 employees @ $200K salary + $400K burden = $2.4M cost

→ Output: 100 units worth $200MScenario B: 20 employees @ $100K salary + $800K burden = $2.8M cost

→ Output: 150 units worth $300MResult: An extra $100M in output for $400K more in labor burden

→ Labor Burden ROI = 250x

When to Use:

Comparing team structures that achieve the same outcome in different ways.

Justifying investments in higher-level or more supported roles.

Evaluating tradeoffs between FTEs and contractors or onshore vs offshore teams.